Currency strength With Alerts Cross Indicator

$590.00 Original price was: $590.00.$110.00Current price is: $110.00.

-

Original Indicator

-

Currency pair: All

-

100% Non-Repaint

-

Platform : Metatrader 4

-

Trading time: Every time

-

Timeframe: All

-

Instant Download in Zip file

-

All Currency Pairs in one chart

-

Life time license with unlimited Pc/Laptop

-

Type of strategy: Scalping and short term or Long term

-

Recommended Broker: ICMARKET EXNESS

Currency strength With Alerts Cross Indicator

Hello dear Traders,

This is our best Forex Trading Indicator.

100% Non repaint Indicator and accuracy 95-98%+

This is the world’s best Indicator for Scalping.

It’s name“Currency strength With Alerts Cross Indicator”

This indicator very easy to use for beginner And fully automatically.

It will never expire and there are NO “monthly fees”

or NO any other recurring charges for use

File type and requirements:-

This is a digital item!(Download links–zip file)

You will Need: MT4 terminal

This files you’ll get is ZIP archive.

Indicator installation Service is Free :- If you don’t know how to install the indicator. Contact me I will install mt4 Indicator in your Pc/Laptop with TeamViewer software

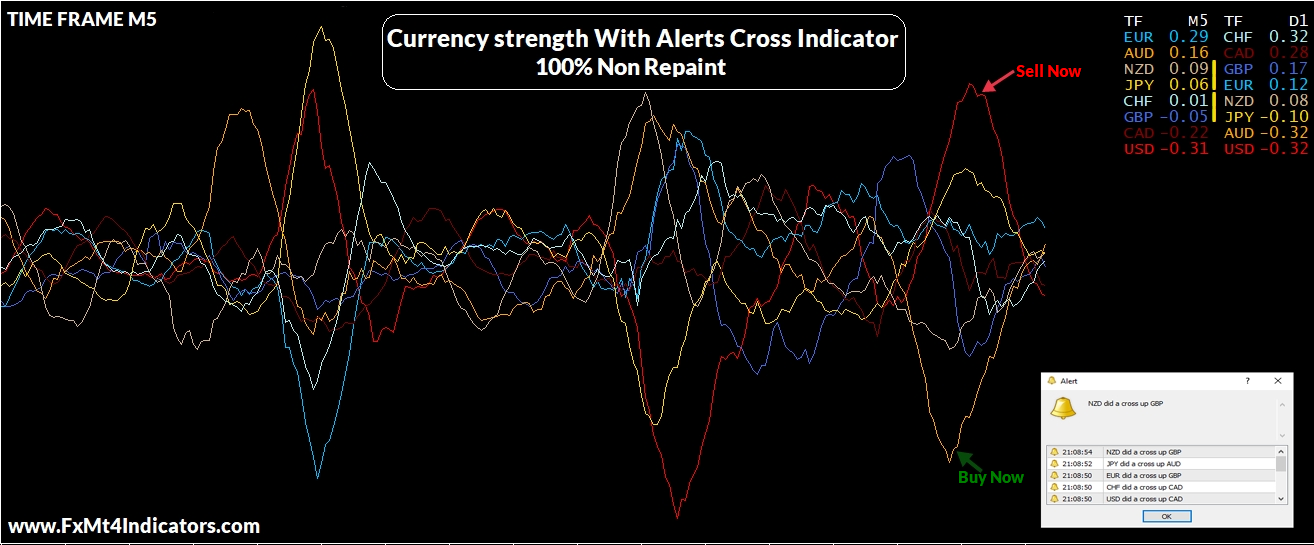

HOW TO USE:-

FOR SELL ENTRY:-

-

1. First option – Cross one line from others line and Generate same time Alert on the top.

-

2. Second option – At the top, one line becomes crooked(In Sell direction)

-

3. Two confirmation found and take Instant Sell entry.

For Example M15 time frame chart :-

-

Current market Red color line became crooked(In Down direction). This is M15 time frame sell entry confirmation.

-

Red color line is all USD pairs. If red color line in top and became crooked. It means All USD Currency pairs is very Strong Buying/selling position then which USD pairs will you buy and sell ?

-

You will Sell :- USDCHF, USDCAD, USDJPY, USDZAR, USDMXN And You will Buy :- EURUSD, GBPUSD, AUDUSD, NZDUSD, XAUUSD, BTCUSD

FOR BUY ENTRY:-

-

1. First option – Cross one line from others line and Generate same time Alert on the bottom.

-

2. Second option – At the bottom, one line becomes crooked(In Buy direction)

-

3. Two confirmation found and take Instant Buy entry.

For Example M15 time frame chart :-

-

Current market ‘light chocolate color’ line became crooked(In Up direction). This is M15 time frame buy entry confirmation.

-

‘light chocolate color’ line is all AUD pairs. If ‘light chocolate color’ line in bottom and became crooked. It means All AUD Currency pairs is very Strong Buying/selling position then which AUD pairs will you buy and sell ?

-

You will Buy :- AUDUSD, AUDCAD, AUDCHF, AUDJPY, AUDNZD And You will Sell :- EURAUD, GBPAUD, XAUAUD

Use the currency strength Indicator and pair the strongest currency with the weakest one — so you get a strong trending market. For example, look at the currency strength Indicator right side above… You can see GBP is the weakest and JPY is the strongest. And when paired together, you get GBP/JPY which is in a strong downtrend.

Currency strength With Alerts Cross Indicator Explained

Currency strength With Alerts Cross Indicator is an advanced Forex tool that measures currency power. It helps a trader determine the direction of a trend and entry points.

To determine how strong the currency is, Currency strength With Alerts Cross Indicator looks at the angle of slope of the TMA (Triangular Moving Average) lines. Instead of using the averaged TMA values, Currency strength With Alerts Cross Indicator transforms them by using its algorithm. This is how it avoids lagging which is characteristic for the TMA.

If the indicator reverses and starts moving back to zero, this means that the price momentum has slowed down. If the slope angle is positive and increasing, the currency price is growing faster. As already mentioned, Currency Slope Strength is more sensitive to price changes than TMA.

The indicator compares the strength of each currency to all other currencies. For example, you’re comparing AUD with USD, EUR, GBP, JPY, CHF, and NZD. If you remove the pairs with AUD from the list, you’ll get a different currency power chart. To measure the strength of the British pound, the indicator adds up the slope angles for all currency pairs with GBP: GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPUSD, GBPNZD, and EURGBP. The sum is then divided by the number of pairs. As a result, we get the average value of GBP strength.

The biggest advantage of the CSS indicator is that it’s easy-to-use and generates straightforward signals. A dramatic deviation from the zero line means that one currency has a solid advantage over the other. The indicator crossing the zero line means that a trend is changing its direction.

Currency strength With Alerts Cross Indicator signals

Lines cross

- If the two lines cross, a trend is changing its direction. In this case, the indicator will notify a trader by displaying a vertical line opposite the currency values.

- If both lines are moving outside the channel, one currency starts to slow down and the other starts to speed up. This signal indicates the emergence of a strong trend, and therefore a good entry opportunity.

- Another scenario is when the lines cross near the zero line and inside the channel. Since neither currency is trending, you shouldn’t count on big profits. This signal may precede the emergence of a strong uptrend or downtrend. The best thing you can do is to wait until the situation clears up.

- One line moves inside the channel, while the other one leaves the channel. This signal says a new trend is emerging.

- One line breaks the upper boundary of the channel, while the other one breaks the opposite boundary. Usually, this signal indicates the emergence of a continuous trend. Note that the lines don’t always cross the boundaries at the same time. The crossings may be days or even weeks apart. Anyway, it’s a lucrative entry opportunity.

Lines move parallel to each other

- The two lines are moving sideways, i.e. parallel to each other. It doesn’t matter in which direction the lines are moving, up or down. The stronger currency is the one moving higher relative to the zero line.

Lines cross the channel boundaries

- Crossing of the +20/-20 levels is one of the major signals generated by the indicator. When it happens, you’ll see a green/red dot in the chart.

If used wisely, the Currency strength With Alerts Cross Indicator has enough advantages to be your primary trading tool. It allows us to assess the potential of currencies in a pair at an early stage of trend formation.

Mistake #1: You randomly use a currency strength Indicator without knowing how it works

Now, a currency strength indicator is like any other trading indicator.

There’s a formula behind it to determine the strength/weakness of a currency.

But if you don’t know the formula behind it, how can you trust the result of the currency strength indicator?

What if the formula is wrong?

What if the currency strength indicator only works on the daily timeframe but, you’re unaware of it, and use it on the lower timeframe?

That’s why no matter what tools or indicators you use, you must always know the formula behind it and how it works.

(And later, I’ll teach you how to create your own currency strength indicator so you have confidence to use it.)

Mistake #2: You use the currency strength indicator to time your entries

Now, a mistake many traders make is to blindly trade based on the currency strength indicator .

For example:

You identify what’s the strongest currency pair right now and immediately buy, thinking the price will move higher — big mistake.

Here’s why…

A currency strength indicator isn’t meant to generate buy/sell signals.

It only tells you which are the strongest/weakest currencies at a point in time.

Let me explain…

According to my currency strength indicator right now, JPY is the strongest and GBP is the weakest…

Mistake #3: The lower timeframe is prone to false signals

Here’s the thing:

Most currency strength indicators calculate the change in price (over a fixed period) to determine which currencies are strong or weak.

But this is prone to false signals on the lower timeframe.

Why?

Because high impact news can cause a “spike” in the price which misleads the strength/weakness of a currency pair.

That’s why you want to use a currency strength indicator which calculates the change in price from the higher timeframe.

And here’s how you do it…

Related products

Indicators

Indicators

Indicators

Indicators

Indicators

Indicators

Indicators

Indicators